Karol Boudreaux criticizes Jendayi Frazer for advocating preferential trade with Africa. She writes:

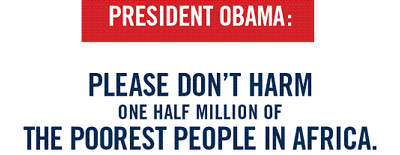

I’m only going to discuss one of her recommendations, which is this: do not extend AGOA trade preferences to a small subset of developing nations that includes some south Asian and some Islamic nations. Ms. Frazer argues: “extending the same trade preferences to hypercompetitive Cambodia and Bangladesh—each of which individually exports more apparel to the U.S. than all of sub-Saharan Africa combined—will undermine the program’s success in Africa.” Here’s a link to the proposed legislation that would expand the trade bill — it’s currently in committee.

But note that the success Ms. Frazer identifies is based on playing favorites. Maybe African producers should be favored over Bangladeshi producers, but on what grounds? A different version of this question would be: “why should African manufacturers be shielded from competition from other developing world producers?”

Boudreaux condemns such preferences as “favoritism” and “protectionism” and argues that more liberal, open trade (combined with better governance) offers the best path for African growth and development. Perhaps. But shouldn’t Boudreaux at least address the respectable economic arguments underpinning the idea that African economies need a foothold to establish nascent industries? Paul Collier and Tony Venables have argued the case for AGOA on such grounds, both in a VoxEU column and in an article in The World Economy.

Africa has lagged behind partly because its economic reforms lagged those of Asia. When export diversification started to boom in Asia in the 1980s, no mainland African country provided a comparable investment climate. Now a number of African cities — Accra, Dakar, Mombassa, Maputo and Dar-es-Salaam, etc. – offer reasonable investment climates, but they cannot compete with Asian cities that have comparable investment climates since the Asian cities have established clusters of firms in the new export sectors. Such clusters provide firms in the cluster with the advantages of shared knowledge, availability of specialist inputs and a developing pool of experienced labour. A classic chicken-and-the-egg problem.

Until African cities can establish such clusters, firms located in Africa face costs that will be above those of Asian competitors, but because costs are currently higher individual firms have no incentive to relocate. If Africa is to diversify its exports and create employment it must develop such efficient clusters of modern sector activity. Where it is feasible, this offers a more reliable development path than the commodity extraction model which Africa has followed to date.

Trade preferences offer a potential solution to the chicken-and-the-egg problem

Boudreaux may be right about the value of trade preferences, but her blog post solely discusses static comparative advantage and competitiveness, whereas industrialization and development is also about dynamic comparative advantage and export diversification.