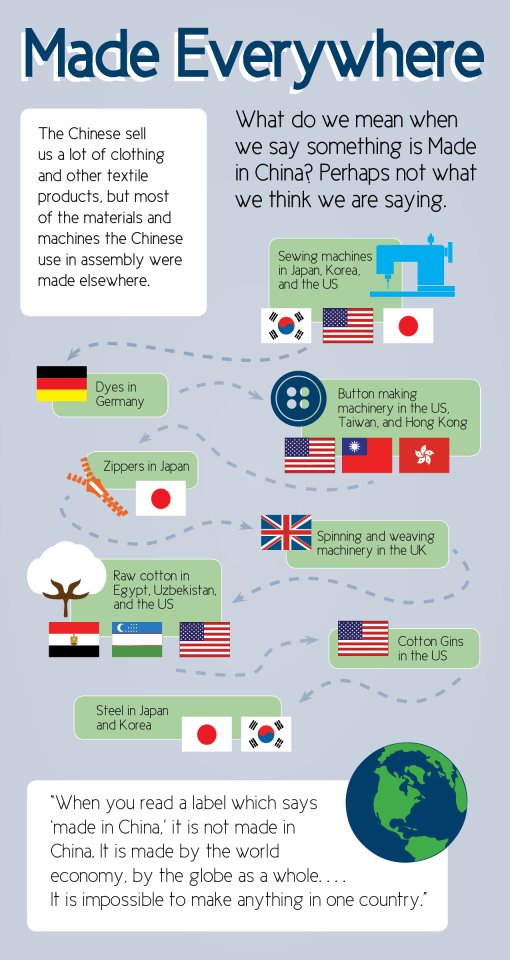

iPhones are a hot example of vertical specialization in the world economy. Scott Lincicome passes along a graphic that describes just how many different economies are involved in producing a single piece of textile clothing.

Tag Archives: Supply chain

Natural disasters and global supply chains

I was on holiday in Bangkok last weekend and witnessed the city’s flooding first hand. Via Sébastien, here’s the global-supply-chain angle on the story:

The world’s biggest names in hard-drive manufacturing, for example, operate from Thailand, where suppliers and customers come together.

Until the floodwaters came, a single facility in Bang Pa-In owned by Western Digital produced one-quarter of the world’s supply of “sliders,” an integral part of hard-disk drives. Over the weekend, workers in bright orange life jackets salvaged what they could from the top floors of the complex. The ground floor resembled an aquarium and the loading bays were home to jumping fish.

“Surely one of the inevitable impacts of this is that never again will so much be concentrated in so few places,” said John Monroe, an expert on storage devices at Gartner, a technology research firm. He estimated it would take a full year for hard-drive production to return to preflood levels.

Séb discusses whether Thailand’s floods and Japan’s earthquake will cause companies to geographically diversify their supply chains.

Asian earthquakes and the global supply chain

Do you remember Barry Lynn? I last mentioned him when Taiwan had an earthquake in 2006. In his 2005 book, End of the Line, he argued that

We have stretched our supply chains so far, and ratcheted them so tight, that even unavoidable natural or political disasters on the far side of the world today can smash like a tsunami right into the center of our own society.

You can imagine how Lynn would react to news stories like this one about global supply chains transmitting the shock of Japan’s earthquake/tsunami:

As Japan’s escalating disaster comes ashore in North America, automakers, suppliers and dealers are preparing for shortages of parts and vehicles.

- On Thursday, March 17, American Honda Motor Co. Executive Vice President John Mendel sent a memo to U.S. Honda and Acura dealers saying the disaster in Japan will disrupt dealer orders into May.

- General Motors’ Shreveport, La., factory, which builds the Chevrolet Colorado and GMC Canyon pickups, closed because it ran out of a Japanese part that it did not identify.

- Toyota Motor Corp. and Subaru of Indiana Automotive Inc. slowed North American production to ration their parts.

Of course, the cost of insuring against such supply shocks would be to build everything twice, which would be enormously expensive. As I reported in 2006, the global economy absorbed the Taiwanese earthquake rather easily. How much trouble will last week’s tragedy transmit outside Japan? Here’s the FT on China’s need for Japanese components and how global companies are reacting to potential disruptions.